How Do I VALUE My Business?

Stuart Mason • 1 October 2024

How Do I Value My Business?

How To Value Your Business - Explained In A VERY Simplistic Way

Valuing a business can feel a bit like trying to price up a second-hand car - there are some general rules of thumb, but everyone’s got an opinion, and the final price might surprise you!

Let’s walk through a simple approach to give a rough idea of what your business might be worth, using the fictional Widget Co. as our guide.

It’s a true saying, “ask ten people to value your business, and you’ll get eleven answers”. This blog post is intended to be the roughest of guides as sadly too many business owners think their non profit making business is worth millions. It could be, but it’s unlikely.

Step 1: Start with the Profit (or "How much dosh does this thing actually make?")

First things first, buyers want to know how much profit the business makes. Widget Co. had a turnover of £400,000, and after paying for everything from widgets to wages, the net profit was £59,000

last year. In the business world, people often talk about “multiples of profit” when valuing a company.

A typical small business might sell for somewhere between 2 to 4 times its annual profit. Some are more, some are less, this is a ROUGH guide.

So, let's take the £59,000

net profit and multiply it by, say, 3 (a middle-of-the-road figure for simplicity’s sake):

£59,000 x 3 = £177,000

That’s a ballpark estimate for the value of Widget Co. based on profits alone.

Step 2: Add the Value of Your Assets (because stuff matters too!)

Now, let’s not forget that Widget Co. owns some pretty valuable things. They’ve got a small industrial unit worth £180,000 and other assets (like equipment, machinery, maybe a couple of laptops and a kettle) valued at £85,000. The value of these assets gets added to the price because, well, they’re worth something!

So, add up the assets:

£180,000 (industrial unit) + £85,000 (other assets) = £265,000

There’s other considerations too, such as intellectual property, customer data (goodwill) etc. These are a bit more complex to value, however, they must be considered.

Again, let’s keep it real. A Go Daddy website with a basic shopping cart is not going to be worth £250,000.

Step 3: Combine the Two (It’s adding time!)

Now we combine the value of the business based on its profit with the value of its assets.

£177,000 (profit-based value) + £265,000 (assets) = £442,000

Voilà! We now have an approximate

value for Widget Co. of £442,000.

Step 4: But Wait, There’s More! (Or Less…)

There are a few other things to consider that might nudge the value up or down. For instance:

• Debts:

If Widget Co. has any loans or outstanding bills, you’d subtract those from the value. No one wants to buy your debt along with your widgets.

• Growth potential:

If Widget Co. has been steadily increasing profits year after year, a buyer might pay more because the future looks bright. We call this “Growth Potential” and have an entire SERIES of modules built around it. It’s THAT important. Again, here’s the warning. These MUST be based on realistic numbers, and not a “pie in the sky” figure. Your £95,000 business is unlikely to have a growth potential of £5m.

• Market conditions:

If the market for widgets is booming, that might push the price up. On the flip side, if everyone’s gone off widgets and started buying gadgets instead, it might lower the value.

Step 5: Have a Chat with a Pro (Because there's always something we've missed!)

This gives you a rough idea, but when it comes to selling a business, it’s always a good idea to get a professional involved, like a business valuer or accountant.

They’ll help you dig into the finer details and make sure you’re not leaving any money on the table—or asking for way too much. We help you prepare for sale and BUILD value, getting an unbiased, independent valuation is key.

Sadly, we see too many brokers massively overvaluing businesses simply to get the upfront fee. Also, avoid your mate down the pub, they can be accurate to +/- 2000%

Summary: Widget Co.'s Value

• Profit-based value: £177,000

• Assets: £265,000

• Total: £442,000

(before any adjustments for debts or market conditions)

And there you have it! A simple, lighthearted way to get a rough idea of what your business is worth. Now, go forth and sell that Widget Co. for a tidy sum!

Or start to prepare your business to sell for MORE.

Hold On, Someone Mentioned EBITDA – What Is That?

Let’s dig a bit deeper into business valuation by introducing a slightly fancier concept: EBITDA. It’s one of those acronyms that sounds scarier than it really is, but once you get to know it, it can be your best mate when valuing a business.

What’s EBITDA and Why Should I Care?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. Sounds like a mouthful, doesn’t it? But really, it’s just a way of looking at how much cold hard cash your business makes from its core operations—before things like loans, tax bills, and the wear and tear on your equipment start muddying the waters.

Basically, EBITDA tells potential buyers how much money the business generates from just doing its thing, which is why it’s often used in valuations. A higher EBITDA usually means a higher valuation, as it reflects the company's earning potential without extra financial baggage.

For smaller businesses a valuation can be obtained using "Sellers Discretionary Earnings" - we'll not muddy the waters with this (separate blog on this), and will be happy to explain the difference if you want to speak with us. This can often favour smaller businesses.

Step 1: Calculate EBITDA (Get to the Good Stuff)

Let’s use our trusty Widget Co. as an example. To calculate EBITDA, we start with the net profit (£59,000 in Widget Co.’s case) and then add back the costs of interest, taxes, depreciation, and amortisation. Here’s how it works:

1. Start with net profit: £59,000

2. Interest: Let’s say Widget Co. is paying £3,000

in loan interest.

3. Taxes: Widget Co. paid £12,000

in taxes last year.

4. Depreciation and amortisation: Widget Co. has some equipment that’s slowly losing value (depreciation), and it costs £5,000

a year. Amortisation is like depreciation but for intangible assets (like patents), but let’s say Widget Co. doesn’t have any of those.

Now, we add these costs back to the net profit to get EBITDA:

EBITDA = £59,000 (net profit) + £3,000 (interest) + £12,000 (taxes) + £5,000 (depreciation)

EBITDA = £79,000

Step 2: Why Buyers Love EBITDA (and why it can affect your valuation)

Buyers love EBITDA because it gives them a clearer view of how much profit the business really makes from its operations. By stripping out things like interest (which depends on how the business is financed) and taxes (which can change based on legal structures), they get a sense of how the business performs at its core.

When valuing a business using EBITDA, the same idea of “multiples” comes into play, much like with profit. Typically, small businesses might sell for between 3 to 5 times EBITDA, depending on the industry, growth potential, and other factors.

Let’s take Widget Co.’s EBITDA of £79,000 and apply a multiple of, say, 4 (right in the middle again, for simplicity):

£79,000 x 4 = £316,000

So, based on EBITDA, the value of Widget Co. could be £316,000.

Step 3: Don’t Forget the Assets (they’re still important!)

Just like before, we can’t forget the valuable assets Widget Co. owns—the industrial unit and other equipment. Those assets, valued at £265,000, need to be added to the EBITDA-based valuation.

So, combine the two:

£316,000 (EBITDA-based value) + £265,000 (assets) = £581,000

Now we have an even more detailed estimate of Widget Co.’s value: £581,000 based on EBITDA and its assets.

Step 4: Which Method is Better—Profit or EBITDA?

Both methods (using net profit or EBITDA) are widely used, but EBITDA is often seen as a more accurate reflection of a business’s true earning potential. It’s especially useful if Widget Co. has a lot of debt or high depreciation expenses that might skew the net profit downwards.

However, smaller businesses might not always have loads of interest, depreciation, or other costs, so using net profit could still give a fairly accurate picture.

Let’s Summarise: Widget Co.'s Value with EBITDA

1. EBITDA calculation: £79,000

2. EBITDA-based value: £316,000 (using a 4x multiple)

3. Add assets: £265,000

4. Total business value: £581,000

And there you go—another way to get an approximation of what Widget Co. might be worth. Now you can walk into those valuation meetings armed with EBITDA, net profit, and a solid understanding of how all the pieces fit together.

You’ll sound like a business valuation pro!

We're all about adding value to your business. Taking the time to get you and your business READY for sale.

80% of businesses that are listed for sale NEVER sell, we'll help you navigate that minefield too.

Would you like to chat? Here's the link.

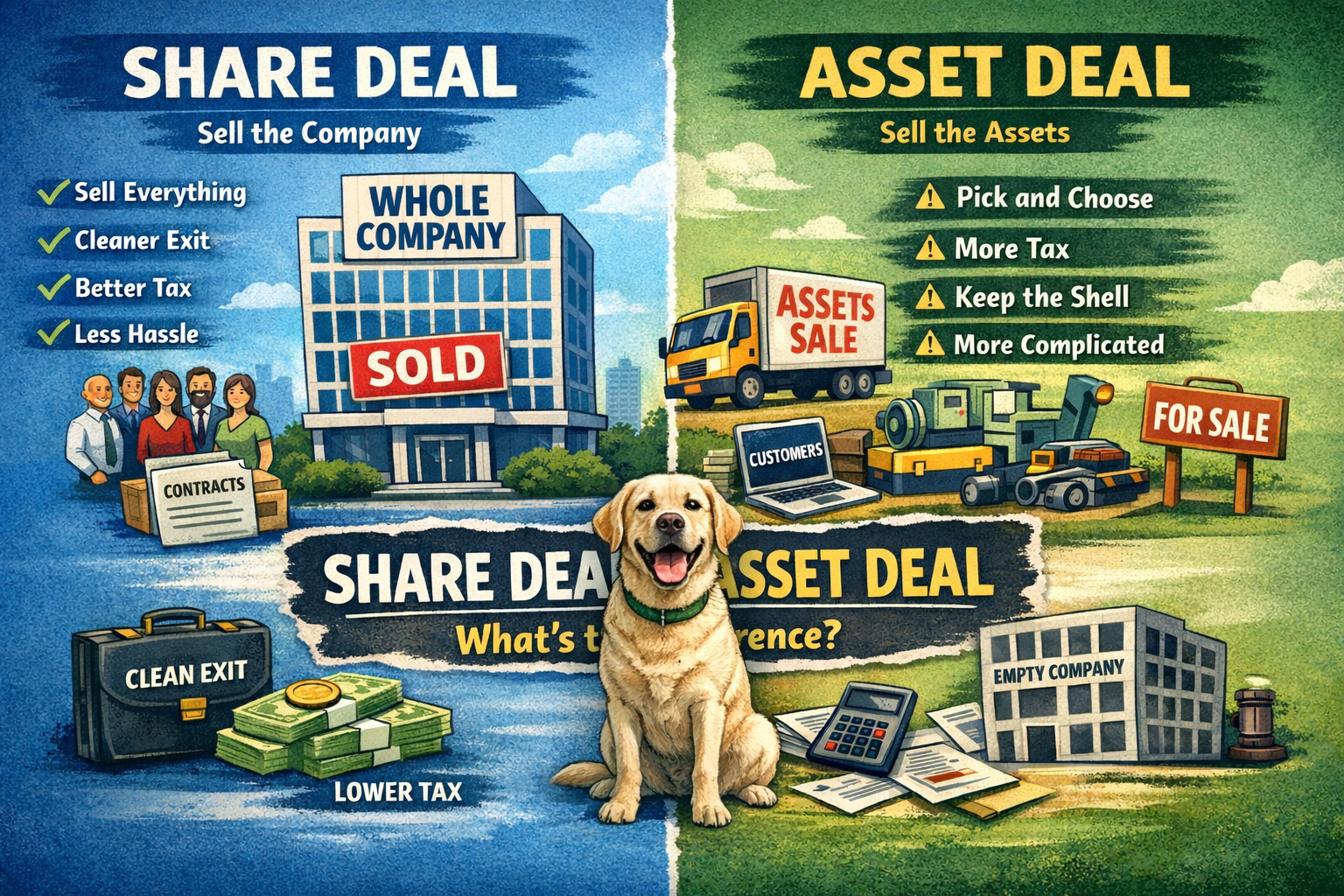

Share Deal vs Asset Deal: What’s the Difference When Selling Your Business? You’re selling your business. Great. Now someone says: “Is it a share deal or an asset deal?” You nod, but inside you panic, because you’re not sure what the difference is. Let’s fix that quickly but in a way your labador will understand, leaving out all the M&A bullshit. First: What Are You Actually Selling? There are two ways to sell a business: • A Share Dea l that’s when you sell the company • An Asset Deal that’s when you sell the stuff That’s it. That’s the whole thing. Everything else is detail. Now let’s break it down so simply it hurts. Share Deal “You Take the Whole Thing” What it is.. You sell your shares in the company. The buyer gets: • The company • The contracts • The customers • The staff • The debts • The skeletons in the cupboard They buy the lot. No cherry-picking. Think of it like selling a house with everything still inside. OK, simple so far, yeah? Why would you choose a share deal? You’d consider a share deal because: • Cleaner exit – you’re done. Walk away. • Tax can be better – often qualifies for Business Asset Disposal Relief (formerly Entrepreneurs’ Relief). That said, Rachel from accounts did a number on this so this is nowhere near as cushy as it used to be. • Contracts stay put – no need to reassign everything. • Staff stay employed – no messy TUPE headaches. In short: Less admin, less hassle, it’s more like “thanks and goodbye”. Still good, yeah? Let’s look at this from the buyers eyes now. Why buyers sometimes hate it • They inherit past mistakes • Old tax issues become their problem (expect to give warranties for this) • Any hidden rubbish comes with the deal (ditto above, they will want assurances) Which is why buyers often push for… Asset Deal – Which Means “I’ll Take the Good Bits” What it is.. You sell specific assets, not the company. That might include: • Equipment • Vehicles • Stock • Customer lists • Brand name • Website • Contracts (sometimes) The company itself stays with you. Think of it like selling the furniture, kitchen, and dog, but keeping the house. Not ideal really is it? Why would you choose an asset deal? You’d consider an asset deal because: • Buyer only wants part of the business • Easier if your company has baggage • Flexible, sell what you want, keep the rest • Useful if the business is struggling but assets still have value It’s often used when: • The buyer doesn’t trust the company history • The business isn’t incorporated properly • There are risks they don’t want touching them Why sellers often hate it • More tax pain – can be less efficient • You may still own a shell company afterwards • Staff and contracts don’t automatically transfer • More admin. More lawyers. More invoices. The Blunt Comparison Thing Share Deal Asset Deal Selling The company The bits Buyer risk Higher Lower Seller hassle Lower Higher Tax (often) Better Worse Clean exit Yes Not always So… Which One Is “Better”? Annoying answer: it depends. Sorry, but it does. This is a blog, not a legal helpline, so it depends!!! Brutally honest answer: • Sellers usually want a share deal • Buyers can prefer an asset deal The final structure is normally decided by: • Tax • Risk • Negotiation power • Who’s more desperate Final Thought (Read This Bit) This is not something you wing. And it’s definitely not something you let your mate “who’s good with numbers” handle. Your mate down the pub “who’s sold a business” is more likely to land you right in the shit… you have been warned. Get: • A proper accountant • A proper solicitor • Advice before you agree anything Because choosing the wrong deal can cost you six figures without you even noticing. If you want, I can: • Explain which one usually suits small UK businesses • Break down tax differences in plain English • Or help you spot which deal a buyer is quietly pushing you into Just say the word. Give me a shout here .

Most business owners assume a sale falls apart because the buyer didn’t have the cash or because the price couldn’t be agreed. In reality, that’s rarely what kills a deal. What really sinks most sales are a handful of hidden problems that only show up once a buyer starts digging. These are the real business sale deal killers, and they explain exactly why buyers walk away halfway through what looked like a sure thing. This is why preparation is key , every one of these deal breakers is avoidable and CATCHABLE with a bit of effort. You have work years, maybe decades, building a business, why rush the sales process now? #1 – The Numbers It usually starts with the numbers. When a buyer begins due diligence, the first thing they look at is your financial records. They don’t expect perfection, but they do expect your figures to be clear, consistent and backed up by evidence. If your profit and loss reports don’t match your tax returns, or if the books are held together by spreadsheets and memory, alarm bells go off. These kinds of due diligence issues create doubt, and doubt is fatal to a deal. Getting proper financial records for sale in place one or two years before you ever think about selling is one of the smartest moves a business owner can make. #2 – Over Reliance On Key Customers Another common problem is over-reliance on a small number of customers. If one or two clients generate a big chunk of your revenue, a buyer will see it as a serious customer concentration risk . In their mind, it only takes one awkward phone call or one lost contract for the whole business to wobble. Buyers want to know that income is spread across many customers and supported by a steady flow of new leads, not propped up by a couple of fragile relationships. In a buyers eyes, those customer relationships can be lost as soon as you leave the business. #3 – The Business Only Works Because of YOU Then there’s the issue of the owner being too important. If you are the person who does all the selling, holds all the key relationships, and makes all the decisions, buyers will struggle to imagine the business surviving without you. From their point of view, they’re not buying a business at all, they’re buying your job. The earlier you start stepping back, documenting how things work and letting your team run the day-to-day operation, the more valuable and saleable the business becomes. Be under NO ILLUSION that a buyer will NOT buy a job, especially a low paying one. #4 Staff Risks Staff can also make or break a sale. Buyers worry about what happens if a key employee leaves the moment the business changes hands. High staff risk is especially dangerous when there are no proper employment contracts, no notice periods and no protection around client relationships or confidential information. A business that depends on one or two people who could walk away is always going to feel risky to a buyer, no matter how good the numbers look. #5 Contracts and Compliance Legal and regulatory issues are another silent deal-killer. During due diligence, buyers will go through your customer agreements, supplier contracts, employment terms, licences, insurance and data protection processes. Weak contracts and compliance can spook even the most enthusiastic buyer. If customers aren’t tied into agreements or if your paperwork is incomplete, the revenue suddenly looks shaky and the legal risk starts to feel uncomfortable. #6 Weak Or Inconsistent Profitability Profitability also plays a bigger role than most owners realise. Big turnover looks impressive, but buyers care far more about stable, predictable profit. If your margins jump around from year to year, it becomes hard for a buyer to forecast what the business will earn in the future. That uncertainty makes them either walk away or push hard for a lower price. #7 Poor Records and Missing Paperwork Finally, there’s the simple but deadly issue of missing or disorganised paperwork. When contracts, leases, licences or ownership documents can’t be found, the buyer starts to wonder what else is hidden. These small due diligence issues slow everything down and quietly erode trust, which is often all it takes for a deal to collapse. This is why buyers walk away so often. It’s rarely about one big disaster. It’s the slow build-up of risk, uncertainty and doubt as they look under the bonnet of the business. The owners who get the best exits understand one thing: you don’t prepare to sell when you want to sell. You prepare years earlier. By sorting out your financial records, reducing customer and staff risk, tightening up your contracts and making the business less dependent on you, you remove the deal-killers before they ever get a chance to do their damage. And when that happens, selling your business becomes far easier, and far more profitable. If you’re serious about planning your exit, there’s a simple three-step path that cuts through the guesswork, and I provide all of it free. Start with the free valuation. It takes five to ten minutes and gives you a fast, high-level snapshot of what your business might be worth. Start that HERE . Once that’s done, the next step is the in-depth valuation . The free one is only a rough guide, this is where the real insight lives. We spend one to two hours pulling your business apart properly, and it’s only for owners who genuinely want to build a saleable, valuable business. Then we lock it all in with a Power Hour . We go through your valuation, your scenario planning and the exact steps that will increase the value of your business and get you exit-ready. By the end, you’ll know what your business is worth, what it could be worth, and exactly what needs to happen to get you there, whether your exit is in two years or ten. It’s never too early to start exit planning, but it can be too late.

If you’ve ever typed “how to sell my business” into Google, here’s a stat that should make you sit up straight, 80% of UK businesses listed for sale never actually sell. Not struggle to sell, not sell for less than expected. They don’t sell at all. And no, it’s not because those businesses are rubbish. It’s because most owners misunderstand what selling a business really involves. Let’s break down why businesses don’t sell, and more importantly, how to make sure yours is one of the 20% that does. Why Businesses Don’t Sell. Most failed sales don’t collapse at the negotiation stage. They fail long before a buyer ever makes an offer. Here are the most common business sale failure reasons I see time and time again in the UK SME market. 1. The Business Is Too Dependent on the Owner This is the biggest killer of SME sales in the UK. • customers want you, not the business • decisions can’t be made without you • key knowledge lives in your head • you can’t step away for more than a few days Then buyers don’t see a business, they see a job that stops working when you leave. Buyers want: • systems • processes • management structure • continuity If removing you causes chaos, the business is unsellable in its current form. 2. Financials Aren’t Buyer-Ready Many owners think, “The accountant sorts all that.” Buyers disagree. Common financial red flags include: • messy or inconsistent management accounts • unclear margins • personal expenses mixed into the business • unexplained fluctuations in profit • no forward forecasts A buyer needs to understand: • how the business makes money • how predictable that income is • how profits can be maintained after you exit If they can’t see that clearly, they either: • walk away, or RUN, or • slash the offer price 3. The Business Has Too Much Risk Buyers don’t buy potential. They buy reduced risk. Key risks that kill SME sales include: • reliance on one or two major customers • key staff who could leave post-sale • informal or missing contracts • poor compliance or documentation • no clear handover plan The higher the perceived risk, the less attractive the business becomes, regardless of turnover. 4. Owners Start Exit Planning Too Late This one hurts the most. Most UK owners only think about selling when: • they’re exhausted • health is suffering • motivation has gone • or they need the money At that point: • options are limited • leverage is gone • buyers can smell urgency Exit planning works best when it starts early , ideally 2–5 years before a sale. Selling a business isn’t an event. It’s a process. How to Be in the 20% That Do Sell The good news? The businesses that do sell aren’t lucky, they’re prepared, and so can YOU. Here’s how to improve business saleability and make your business attractive to buyers. 1. Prepare the Business for Sale (Not Just the Listing) Putting a business “on the market” is not preparation. Preparation means: • reducing owner dependency • cleaning up financials • documenting systems and processes • strengthening management • addressing risks before buyers find them This is why exit planning matters. You’re not preparing to sell today, you’re preparing to be sellable at any time. 2. Make the Business Run Without You The more the business works without you, the more valuable it becomes. This involves: • SOPs and documented processes • clear roles and responsibilities • delegated decision-making • management accountability Ironically, this often improves: • profit • work-life balance • and growth Even if you decide not to sell you now have a business that’s a lot more enjoyable and profitable. That's what we refer to as "The Business Exit PARADOX". 3. Make the Numbers Clear, Credible and Defensible Buyer-ready financials include: • consistent management accounts • clear EBITDA • justified add-backs • predictable cashflow • transparent reporting If a buyer can’t understand your numbers quickly, they won’t trust them. And no trust = no deal. 4. Reduce Risk Everywhere You Can Every risk you remove: • increases buyer confidence • increases valuation • increases likelihood of sale This includes: • diversifying customers • securing key staff • tightening contracts • improving compliance • creating handover plans Low-risk businesses attract more buyers , and more buyers mean better outcomes. The Reality of SME Sale in the UK Most SME owners believe that “My business will sell when the time comes.” Statistically, that’s unlikely without preparation. The owners who succeed: • plan early • get honest about weaknesses • fix problems before they become deal-breakers They don’t hope for a sale. They engineer one. They CREATE the opportunities , not wait for them. Final Thought: Exit Planning Isn’t Just About Selling Here’s the twist most owners don’t expect. Once you prepare your business properly: • stress reduces • hours drop • profits often improve And many owners realise they don’t actually want to sell, they just wanted options. That’s the real power of exit planning. That’s what we refer to at Junction Twenty as “The Business Exit Paradox”. Want to Know Where Your Business Stands? If you want to find out: • why your business would or wouldn’t sell • what’s holding value back • what buyers would challenge • and how to fix it Start with a proper exit readiness review, before the market decides for you. The great news, Junction Twent y is now an official partner with BizVal , so we take business valuations seriously, and not with a pinch of salt. Use this link, an d let’s talk about what’s best for you. The Valuation is NOT free (it’s £99), but the chat beforehand is both free and very worthwhile. Because the difference between the 80% and the 20% isn’t luck… It’s preparation.

Can My Business Be Sold, It’s Just Me? Who Will Buy It? Why Solopreneur Businesses Do Have Value, and CAN Be Sold Let’s clear something up straight away. If your business is small, if it’s just you, if it relies heavily on you showing up to make the magic happen, that does not mean it has no value. This may sound contradictory to what you’ve been told and read before, and indeed IT IS , but bear with me here. But the fact is, for the right buyer, that’s not a weakness at all. It’s the entire appeal. There’s a persistent myth floating around the business world that only slick, systemised, staff-heavy businesses are worth anything. You know the type: layers of management, complicated org charts, and a payroll that would clear the debt of a third world country. But that’s only valuable to one type of buyer. We’re going to talk about an increasing number of “Lifestyle Business Buyers”, a whole other group of buyers out there quietly looking for something very different. Meet the Lifestyle Buyer Lifestyle Business buyers aren’t looking to be the next Elon Musk or planning to flip the business in three years. They’re looking for something far more human. Common examples include: • Teachers leaving the profession who still want meaningful work without marking homework at midnight. • Couples looking for a business that fits around family, travel, or shared values. • Corporate escapees who’ve had enough of pointless meetings and “circle back” emails. • Professionals in their 40s and 50s who want income, autonomy, and sanity, not stress and a team of hundreds. What they’re not looking for? • Managing staff. • Office politics. • HR headaches. • Becoming a full-time firefighter for other people’s problems. They want control, clarity, and a business that works with their life, not against it. And that’s exactly where solopreneur businesses shine. The Big Myth: “If It Relies on the Owner, It Has No Value” - It's Different Rules For A Lifestyle Buyer. This idea needs to be gently but firmly shown the door. Yes, some buyers want businesses that run without them. But others want the opposite. It is worth mentioning here that while “Lifestyle Buyers” will be interested in a “Solopreneur” or Micro Business, it still has to be well structured, well systemised, have tidy financials etc. If your business is an absolute chaotic shit show with every process in your head, that business has ZERO value. This is why 80%+ of businesses listed for sale in the UK NEVER sell, they are unsellable. A Solopreneur business has value that: • Needs one capable person. • Has clear services. • Has loyal customers • Generates predictable income. • Doesn’t require hiring anyone. They also want a business that is not broken, they want a business that’s perfectly positioned for them as the new buyer to step into a role, not build an empire. Think of it like buying a job, but a better one. As a “Lifestyle Business BUYER” : - • You choose the hours. • You choose the clients. • You choose the direction. • You keep the upside. For many buyers, that’s the dream. Why Owner-Led Businesses Can Be More Attractive Here’s why “owner-reliant” can actually be a selling point: 1. Simplicity No teams. No drama. No endless management tasks. The buyer knows exactly what they’re getting. I must stress again though that systems, processes and structure are still vital. Everything in the head of the current owner is a deal breaker. 2. Lower Risk Fewer moving parts = fewer things to go wrong. Lifestyle buyers don’t want complexity. They want stability. Most Lifestyle Buyers have had years of corporate stress and hassle, they want away from that, not PAYING for more. 3. Easier Transition If the business is built around one person, it’s easier to hand over properly: • Training, a clean handover is vital, in effect, they become you. Expect a sensible hand over period, more to ensure a smooth customer transition. • Client introductions, as above, the old owner needs to slowly introduce the new owner. • Knowledge transfer, but without needing a full brain transplant to pass on that knowledge. That’s far simpler than inheriting a disgruntled team you’ve never met. 4. Values Alignment Many lifestyle buyers care deeply about how they work. Many will be buying businesses that align with their core values. • Ethical practices • Community focus • Flexibility • Sustainability Micro businesses often already embody these values, that’s where you have a distinct advantage. “But I Don’t Want to Employ Anyone…” Good. That’s not a flaw. That’s a filter. You’re not trying to sell to everyone. You’re selling to someone specific. There is a huge and growing market of people buying businesses who: • Don’t want staff. • Don’t want growth for growth’s sake. • Don’t want to scale into exhaustion. They have already done this, they want away from that, not more of it. What they want, what they really, really want: • A decent income. • Control of their time. • Work they actually enjoy. That’s a completely valid business model. So, In Summary - What Actually Creates Value in a Solopreneur Business? Value doesn’t come from headcount. It comes from things like: • Consistent revenue. • Clear services or offers. • A recognisable brand or reputation. • Repeat customers or referrals. • Documented processes (even simple ones). • Proof the business supports a decent lifestyle. If your business does those things, it has value. It may not suit a private equity firm, but it doesn’t need to, you’re not even remotely interested in pitching there. The Bottom Line Micro businesses and solopreneur businesses can be sold. They do have value. And for lifestyle buyers, they’re often exactly what’s wanted. So if you’ve ever thought: “It’s just me, so it’s probably not worth much…” Think again. To the right buyer, your business isn’t “too small”. It’s just right. How Do You PREPARE Your Micro Business for Sale? That’s the easy bit, I have a monthly course, nine modules over nine months that get you and your business prepared. This course is designed ONLY for Solopreneurs and Micro Business Owners. Be one of the 20% that do sell on not one of the 80% that don’t. Would you like to chat more about this?

Who Will Actually BUY My Business? The 3 Types of Buyers You’ll Meet When Selling Your Business., an d why they’re not all created equal When business owners talk about “selling up”, they often imagine one mythical buyer turning up with a huge bundle of cash, and after a brief discussion, the deal is made. Not even close. In reality, most small businesses meet three very different types of buyers. Each comes with their own mindset, motivations, and ability (or inability) to pay what your business is actually worth. Let’s break them down, then you’ll be able to identify which one suits you best. 1. The Lifestyle Buyer Who they are: Usually an individual (or couple) buying themselves a job. Often escaping corporate life, redundancy, or mid-life boredom. Key traits • Wants steady income and stability. • Likes simple, understandable businesses. • Nervous about risk and change. • Often needs training and hand-holding. Advantages • Emotionally invested. • Usually serious once committed. • Can move quickly if the business feels “safe”. Disadvantages • Price sensitive. • Lower valuations (typically 2–3x profit). • Easily spooked by complexity or heavy owner reliance. Bottom line: They’re buying a lifestyle, not growth or scale. Most lifestyle business buyers expect to be heavily involved with the business. That doesn’t mean they will buy chaos, indeed, the total opposite. A lifestyle buyer will be looking for systems, processes and a systemised business. 2. The Strategic Buyer Who they are: Another business in your industry (or nearby), looking to bolt you onto what they already have. This is where most business sales are. This could be a local competitor or a non competing competitor looking to expand into your area. It could also be a business in a related industry looking for new income streams within the same client base Key traits • Focused on synergy and efficiency. • Sees value in customers, staff, systems, or licences. • Less emotional, more calculated. • Often already profitable without you. Advantages • Often the highest offers. • Less concerned about small inefficiencies. • Faster growth potential post-sale. Disadvantages • Tough negotiators. • Will challenge every number. • May want you out quickly after handover. Bottom line: They’re buying what your business adds to theirs, not just your profit. 3. The Financial Buyer Who they are: Investors, acquisition entrepreneurs, or small private equity groups buying for return on investment. Small business owners dream of Peter Jones coming along and investing in their business, sadly, for most, that ain’t the case. Investors will have ZERO interest in a business that is owner reliant, shows low scaling opportunities and/or lacks solid IP. Key traits • Obsessed with numbers and forecasts. • Loves systems and processes. • Hates owner-dependency. • Very thorough due diligence. Advantages • Professional and structured. • Can pay strong multiples if risk is low. • Sees upside in scalable businesses. Disadvantages • Long sales process. • Endless questions. • Zero emotional attachment. Bottom line: If your business runs without you, they’ll pay more. If it doesn’t, they won’t. The honest truth Most small businesses attract lifestyle buyers by default. The businesses that sell for serious money are the ones built to attract strategic and financial buyers. That means: • Systems, not heroics. Preparation is KEY here. • Predictable profits, not “busy”. Profit not turnover wins the day. • A business that works without you. Not a fortnight off, that’s a business that can manage without you, not run without you. Build for all three, and you get options. And options are where the leverage (and better exits) live. It’s never too early to start exit planning, but it can be too late. It's never to early to TALK about exit planning either. It can take 2-3 years to see changes on your bottom line.

Thinking of selling your business “one day”? That day comes faster than you think. Here’s how to plan your exit properly without giving yourself a whole load of added stress. Why Plan So Early? Most micro-business owners are so busy running their business that they forget to prepare to leave it. But here’s the thing: exiting a business isn’t a one-off event, it’s a process. Ideally, it starts 2 to 5 years before you want to walk away. Why? Because a good exit takes time. You need to: • Maximise business value • Get your financials in order • Find the right buyer (or successor) • Prepare emotionally and practically to move on • Knowing that 80% of businesses listed NEVER sell. So, if you think your future self might want to sell, retire, or simply do something else… it’s time to lay the groundwork. The best time to start this was yesterday, don’t wait until tomorrow – start today. Step 1: Define Your Personal Goals Your exit plan starts with one simple question: what do you actually want next? • Are you aiming to retire? • Do you want to start something new? • Do you need a lump sum, or ongoing income? Knowing this helps you set a target sale value or outcome. It also affects who the best buyer might be. Jct20 Tip: Write down what your “perfect exit” looks like. Be honest. Beach? Bungalow? Brewing your own beer? Step 2: Get a Rough Valuation Before you can improve the value of your business, you need a ballpark figure for what it’s worth now. • We’ll help you with a realistic valuation, and the factors that influence it. • Get clear on how valuation works in your sector (e.g., profits, assets, client base, goodwill) Most micro-businesses are worth 2–3 × annual profit, but only if they don’t rely solely on the owner. (We’ll come back to that.) Step 3: Make Yourself Redundant – We Call This “Kill Bill” One of the biggest things that kills a sale? The business can’t run without you. Start shifting key tasks to: • Systems • Software • Staff (if you have any) • Freelancers or outsourced providers Document your processes (aka Standard Operating Procedures) so someone else could take over. Even if you’re a one-person show now, show a buyer they could easily grow the business with help. Remember this, without the above, you don’t have a business, you have a job, and no one want to buy a job. Step 4: Clean Up Your Financials Would you buy a car without seeing the service history? Exactly. Buyers want: • Clear, accurate financial records (ideally 3+ years) • Up-to-date tax filings • Profit-and-loss statements that make sense • Minimal personal expenses muddled into business costs • Realistic growth projections that can be quantified. If your books are messy, get an accountant or bookkeeper to sort them well in advance. Step 5: Increase Business Value This is your chance to make the business more appealing (and more profitable): • Add recurring income – Subscriptions, retainers, contracts. • Diversify your client base – Avoid relying too heavily on one big client. • Raise prices – Charge what you’re worth. • Strengthen your brand – Website, testimonials, trust. • Reduce costs – you will be amazed by all the extra costs that “creep in” – every £1 of costs comes right off your bottom line. Each of these makes your business less risky and more valuable to a buyer. Step 6: Know Your Exit Options Not every sale is a big cheque from a stranger. Think through: • Trade sale – Sell to another business in your industry. • Management buyout – Your team takes over. • Family succession – Hand it to the next generation. • Employee ownership – Like an Employee Ownership Trust. • Wind-down – Sometimes, the best option is to close gracefully. Each path has pros, cons, and tax implications. Get advice early! Step 7: Build a Team of Advisers - NOT mates down the pub that know someone Don’t try to DIY your exit, especially not in the final stretch. Assemble your exit squad: • Accountant (preferably one who’s helped others sell) • We’ll help you prepare, but you’ll still need a trusted broker (we can help there too) • Solicitor familiar with small business sales • A good wealth planner, tax advisor and financial advisor. The earlier they’re involved, the more they can help you shape the business into something someone actually wants to buy. Step 8: Get Emotionally Ready Letting go can be tough, even if you're ready financially. 75% of business owners regret exiting in the first year after sale. • Start creating a post-exit plan • Test out taking more time away from the business • Talk to other owners who’ve exited A successful sale doesn’t just fill your bank account, it gives you freedom, peace of mind, and a clean handover. Final Thought Exit planning isn’t just about selling, it’s about future-proofing your business, creating options, and building a life you want. Ironically, preparing a business for sale could actually mean you no longer need or want to sell. Even if you’re not 100% sure when you’ll sell, starting 2–5 years in advance gives you breathing room to get the best deal, and on your own terms. The worst scenario in the world is when you need to sell. Did this help ? Stay tuned for more helpful info and blogs. Want help making your business more sellable? Get in touch, exit planning isn’t just for big corporations. Drop me a message , always happy to have an initial chat. Remember 80% of businesses listed never sell, because, sadly, they are not sellable.

What Makes a Small Business Attractive to Buyers? (Hint: It's Not Just Profit) Look at this as Tinder, for business… Let’s cut right to the chase. You know I’m blunt, direct, streetwise, and often just plain rude, but it needs to be. Just because your business is busy, profitable, and well known locally, doesn’t mean anyone wants to buy it. Shocking? Maybe. But it’s true. This was me. I had an award-winning, multi-million pound business that was making a TON of money. That business was worth a FRACTION of what it could have been worth. WHY? Because the business was ME. It’s all covered in the Amazon #1 Best Seller – “How To Wreck Your Business” When buyers are scoping out small businesses, they’re not just looking at how much cash it throws off, they’re asking one crucial question: “Can I run this without the current owner? Can this thing run without falling apart? Am I buying a business or a job?” If the answer is “errr… maybe, but not really” — you’ve got some work to do. Remember this. Over 80% of businesses listed for sale NEVER SELL. It’s not because they are bad businesses, it’s not because they are not making money. It’s because the business is NOT SELLABLE. Here’s what actually makes your business attractive to buyers, and what might be quietly killing your chances of a successful (and profitable) exit. 1. It Can Run Without You Being There Every Bloody Day If your business runs on your blood, sweat and weekends, it’s not a business, it’s a job. End of. And buyers don’t want to buy your job. They want to buy an asset that works without you. I created a module called “Kill Bill” – let me know if you’d like to try that. It’s perfect for this. Attractive businesses have: • Clear roles and responsibilities (not just “ask Dave, he knows”) • A team that can deliver without owner hand-holding • Systems and processes that are actually written down and used Hard truth: If you’re the engine, the glue, the fire extinguisher, and the decision-maker, you’re also the liability. 2. Clean, Understandable Financials Buyers aren’t mind readers, and they definitely don’t want to play forensic accountant just to figure out where the money goes. If your books are a mess, or your accountant is “creative”, you’re asking buyers to take a gamble. Most won’t. Due Diligence will be TOUGH for you in cases like this. What buyers want to see: • At least 3 years of clean, accurate financials • A clear picture of profit (not buried in your cousin’s mobile phone bill) • A reasonable salary for the owner factored in Pro tip: Get a good accountant who knows what buyers look for, not just how to minimise your tax bill. 3. Recurring Revenue or Repeat Customers A steady stream of income makes your business far more valuable. It gives buyers predictability, and that’s like gold dust. Great signs: • Contracts, retainers or subscription-style models • Loyal repeat customers (tracked in a CRM or database, not your head) • Sales that aren’t totally random or seasonal No one wants to spend half a million buying a “feast or famine” setup. 4. Strong Brand and Reputation (Beyond Your Personal Name) If you are the brand, you’ve got a problem. Because when you walk out the door, the brand equity goes with you. Buyers want a business with a reputation that stands on its own. That means: • A memorable business name • Positive reviews, testimonials, and word-of-mouth reputation • Marketing that doesn’t rely on your personal Facebook profile You can still be involved — but if the brand falls apart without you, you’re not selling a business, you’re selling yourself short. 5. Documented Systems and Processes This is the boring bit no one wants to hear, but it’s the key to unlocking serious buyer interest. Good CRM’s are worth their weight in gold. When I had my business we created our own CRM (that’s another story). When systems are documented, you’re selling a machine. When they’re not, you’re selling chaos with a smiley face. Examples of sellable systems: • A step-by-step onboarding process for customers • A repeatable quoting or estimating process • Staff handbooks, training manuals, or SOPs Systems = scalability. And buyers love things they can scale. 6. A Clear Growth Story or Opportunity A business that’s just “plodding along” might be fine for lifestyle owners. But serious buyers want to know there’s room to grow. Avoid at all costs saying “this business has great potential” – show it, document it, roadmap it. I have a module called “The Growth Curve” that nails this. Can they add new locations? Upsell services? Cut costs or automate? You don’t need to be growing now but the potential should be obvious and compelling. If your business feels like it’s already peaked, you’ll have to work harder to get anyone excited about buying it. I refer to all this as “Desirability”, it’s an entire module in Junction Twenty. Final Thoughts from me: If your business isn’t attractive to buyers — it’s probably not in great shape for you, either. Making it more sellable doesn’t just help with an exit. It makes your life easier right now, more profit, less chaos, fewer emergencies. So even if you’re not thinking of selling this year (or even this decade), here’s your wake-up call: Start building a business someone would want to buy, so one day, you’re not forced to walk away from it with nothing. Start with the end in mind. Let me be blunt, having a business that is SELLABLE more often than not means you won’t want to sell it. Why would you sell a cash cow asset that is FUN ????? Want help getting your business sale-ready? We work with small business owners who want to go from chaotic but profitable to sellable and scalable. No fluff. No faff. Just real, practical steps to get your business in shape. Use this link to get started, let's have a quick chat? Have a peak at my website too. The programme is called "Junction Twenty" - it's the smart way for small business owners to plan their exit.

How Do I Sell My Business Quickly? How to Sell Your Small Business Quickly (Without Losing Your Sanity) So, you’ve decided it’s time to sell your small business. Maybe you’re ready for a new adventure, maybe you’re tired of customers who think deadlines are optional, or maybe you just want to spend your days somewhere other than glued to your phone. Whatever the reason, you want to sell – and you want to do it fast.... Selling a business isn’t quite as simple as whacking a ‘For Sale’ sign in the window and hoping for the best. But don’t worry – here’s how to get it done efficiently and without too much stress. There’s a few horrible statistics you need to know. We know, most statistics are made up, but sadly these ones aren’t. 80% of Businesses listed for sale NEVER sell – ever. Also, 75% of business owners regret selling within a year of exit. The reason? Lack of preparation OR an unrealistic expectation of selling price. A business turning over £100,000 and making £500 net profit is not going to sell for £1.5m. Here’s a few of our tips and things we help with – ‘cuase we’re nice that way. We’ll help you whether you use us or not. 1. Get Your House in Order (Literally and Financially) Before you even think about listing your business, you need to get your books in order. Buyers love tidy financials – not shoeboxes full of crumpled receipts. Make sure your accounts are up to date, debts are minimised, and any pesky tax issues are sorted. Also, consider the aesthetics. A business that looks well-organised and running smoothly is far more attractive than one that resembles a sinking ship. If your website looks like it was built in 2008 or your shopfront has seen better days, a bit of sprucing up won’t hurt. 2. Know What Your Business is Worth (And Be Realistic) Yes, you’ve put your heart and soul into this business, but that doesn’t mean someone will pay over the odds just because you love it. Get a realistic valuation – it’s really easy to get a simple industry-based multiple of your profits. That will give you a rough guide. Also, be prepared to justify your price. If your valuation is based on ‘fantasy island’ rather than hard numbers, a buyer will likely try to knock it down faster than a dodgy garden fence. 3. Find the Right Buyer – Quickly Time is of the essence, so start with the most likely buyers. Competitors, suppliers, employees, or investors already familiar with your business might be interested. If none of them bite, a business broker or online business marketplace can help find a wider audience. And let’s be honest – selling to someone who already understands the business means fewer awkward ‘How does this work?’ conversations down the line. Make up a list NOW of all your potential buyers. You’ll be surprised how many there could be. 4. Keep Things Hush-Hush (For Now) The last thing you want is staff and customers panicking because they think the ship is sinking. Keep the sale confidential until you’ve found a serious buyer. Once you’ve got a solid offer, then you can break the news gently. You may have go to the “Open Market” to increase your reach and increase your sale options and chances – this does carry RISK though. 5. Have Your Exit Plan Ready A quick sale means you need to be ready to hand over the reins smoothly. That means having transition plans, supplier contacts, and key processes documented. If you can offer training or support post-sale, it makes your business even more attractive. We can help here. Also ask us for our “Due Diligence” Checklist – that could be a life saver. 6. Don’t Get Bogged Down in the Negotiation Selling a business can sometimes turn into a long-winded back-and-forth. Be clear on what you will and won’t accept early on. If someone tries to haggle you down to the cost of a second-hand van, don’t waste time – move on to the next buyer. Again, use our “Due Diligence” Checklist – preparing for what WILL be asked for will save you time and SANITY later on. 7. Close the Deal (Properly!) Once you’ve found your buyer and agreed on a price, make sure the legal side is watertight. Get contracts drawn up, ensure payment terms are crystal clear, and don’t hand over the keys until the money is in your account. Jimmy down the pub has sold many businesses, we see Jimmy’s all the time – trust us - get PROFESSIONAL advice. If you think good legal advice costs a lot – wait until you see what shit legal advice will cost you. Final Thoughts Selling your business quickly doesn’t have to be a nightmare. If you get your finances in order, set a fair price, find the right buyer, and keep things professional, you’ll be sipping celebratory drinks before you know it. And who knows? Maybe your next big venture is just around the corner – preferably one that involves fewer emails and more relaxation! Selling quickly has many disadvantages. Your potential buyer may smell an opportunity. You’ll be restricted on time to market your business. You’ll also have limited time to PREPARE. For that reason, a “Quick Sale” is 6-12 months, any less than that, and you could be heading for stormy waters Good luck – and happy selling! If you need help - this is what we do. Help you PREPARE to EXIT for MORE .

Picture this: you're selling your business, and suddenly you're bombarded with fancy acronyms like SDE and EBITDA . Let's break it down with a dash of humour - because we like to keep things simple. SDE (Seller's Discretionary Earnings) is like the superhero cape of your business. It's your earnings plus all those extra perks and quirks that make your business special. Think of it as your business's "net income" plus the sweet perks like company car usage, travel expenses, and that weekly pizza party you throw for your team (because happy employees are productive employees, right?). On the other hand, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is like looking at your business through X-ray vision. It strips away all the extra fluff (like those pizza parties) and focuses solely on your business's operational performance. It's like saying, "Hey, let's see how much money this baby is making before we start considering the financial gymnastics." In simple terms, small businesses tend to use SDE , and it’s always a juicer figure than EBITDA which is usually reserved for the mid to large businesses… aka “The Big Boys” (Gender Neutral Term). So, when it's time to sell your business, remember this: SDE adds the sparkle and charm, while EBITDA gives you a no-nonsense, stripped-down view. SDE will always be more than EBITDA. HOWEVER... ***WARNING*** - The Homer Simpson RED ALARM... Just because it "values" more, does NOT mean you'll SELL for more. It's like trying to sell your house with or without all the fancy furniture inside. One's the full package deal, and the other's the bare bones. Choose wisely, and may the sale be ever in your favour. Now the really super icing on the cake bit, with a cherry. You can get your FREE business score and see how your business compares with others in your industry (much better surely), and… yes, using the SDE Valuation, an indication of how much your business is worth. How cool is that? Well also add another cherry (watch those calories) as we’ll include some hints, tips and advice on how to IMPROVE your business VALUE – so you can buy MANY more pizzas and cakes. Sound fair? If you want extra Pepperoni on your business sale, let’s have a chat. You’ll be surprised how easy it is to ADD value.

Locked Box vs Completion Accounts: A Small Business Owner’s Guide The Your Labrador Can Understand. So, you've decided to sell your business, and you’re working hard with the Junction 20 content to PREPARE your business and sell for more. Awesome. It’s your baby, your pride and joy. It's been a wild ride, from burning the midnight oil (and probably burning a few kitchen appliances) to celebrating that first sale that wasn’t to your mum. Now, you're on the brink of passing the baton, and suddenly you're hit with terms like "Locked Box" and "Completion Accounts." If you're scratching your head thinking, "Are these types of padlocks? Do I need a key for this?", don't worry. We're going to break it down for you, with a dash of humour to keep things light, and write it in a way a labrador will understand. Why? Because it annoys us that so many brokers and consultants use weighty text and terms in a bid to justify fees. What on Earth is a Locked Box? Let's start with the Locked Box mechanism, which - spoiler alert - doesn't involve actual padlocks, handcuffs or safes. Sorry to disappoint. So, keep your handcuffs for other things, moving swiftly along… The Locked Box is a financial system used in business sales. It's all about freezing the accounts of your business at a specific date (known as the "Locked Box Date"). Think of it like a financial time capsule: you decide on a date when the accounts are "locked," and after that, you, as the seller, agree not to take out or put in any sneaky last-minute transactions. Here’s a very relatable scenario: • Imagine you’re selling your local bakery (you’ve made a killing with those award-winning scones). • The buyer and you agree that on 31st March, you’ll lock the box. • From that point on, the buyer will treat the business as though it were already theirs. No sneaky spending, like ordering yourself a new industrial oven "on the house" after the agreed date. Everything is frozen, except for regular operational stuff like paying your staff or, in the bakery’s case, buying flour (because we can’t have a flour-less bakery). You, the seller, pocket the business’s profits up until 31st March. After that, anything the business makes or spends is the buyer's responsibility. Locked Box: Pros and Cons Pros: • Simplicity: The price is fixed, no surprises. • No ongoing haggling: Once that box is locked, there’s no need for you and the buyer to argue over receipts or sneaky post-sale adjustments. • Predictability: Both you and the buyer know what’s happening from the get-go. Cons: • Trust Issues: The buyer has to trust you haven’t drained the business’s coffers before locking the box. So, no cheeky bonuses or splurges on “business” trips to the Maldives. Completion Accounts: A Different Game Altogether Now let’s look at Completion Accounts, which are a little more “wait and see” in nature. If a Locked Box is like agreeing on the sale price today and walking away, Completion Accounts are more like selling a house where you promise to take care of the lawn and make sure the plumbing works before handing over the keys. It’s all about settling the sale after the fact, with a bit more back and forth. Here’s how it works: • You agree to sell the bakery on 31st March. • But instead of fixing the price, you and the buyer wait until after the sale to finalise the accounts. • On completion day, the buyer wants to see what’s really in the cupboards (financially speaking). They’ll go over the business’s assets, liabilities, cash flow, and debts like a financial detective. Based on this, they’ll adjust the final price. So, if you’ve mysteriously been stockpiling sugar mountains, they’ll adjust the price downward. Imagine this: After the sale, the buyer finds out you owe a flour supplier £5,000 (because who doesn’t need massive quantities of flour in a bakery?). They’ll subtract that from what they agreed to pay you. On the flip side, if there’s more cash in the till than expected, you might walk away with a bit extra. Completion Accounts: Pros and Cons Pros: • More flexibility: The price can be adjusted after sale, depending on how the business performs up to completion. • Fair for both sides: If your business did great leading up to the sale, you could get a higher price. Cons: • Complicated: You might have to go back and forth with the buyer over small financial details. Imagine explaining to them why the bakery needed a new industrial-grade coffee machine two days before the sale. • Time-consuming: Finalising the accounts post-sale can drag on, meaning it could be months before you know how much you’re actually getting. Which One Should You Choose? Now comes the golden question: should you go with the Locked Box or Completion Accounts? • If you're a no-nonsense type who likes certainty, go for the Locked Box. You can lock in a price, hand over the business, and sail off into the sunset knowing your sale price won’t change. You can plan that post-exit holiday without worrying about future financial wrangling. • If you're someone who enjoys a flexible approach (or perhaps you think your business might outperform expectations in the months leading up to the sale), then Completion Accounts might be for you. Just be prepared for a bit more post-sale paperwork and some potential price fluctuations. A Final Word of Advice (and a Cup of Tea) Whichever you choose, make sure you’ve got a solicitor to help you navigate the small print. This is vital. We provide guidance and help on how to PREPARE you and your business for sale, like most in the "advisory space", we're NOT legal experts. Selling a business is no small feat, but understanding these two mechanisms - Locked Box and Completion Accounts - can make the process smoother. And let’s face it, there’s nothing wrong with feeling like a financial wizard when you’ve grasped the difference between the two! So, take a deep breath, have a cuppa, and get ready to sell that business like the savvy entrepreneur you are! Would you like to discuss this further? Then let's have a chat.